1/5

What is Compliance Management?

Compliance management refers to the process of ensuring that a business operates within the framework of laws, regulations, and industry standards. It covers various aspects, including:

- Corporate Compliance: Business registrations, tax filings, and annual reports.

- HR Compliance: Employee contracts, labor laws, workplace safety.

- Financial Compliance: Audits, financial reporting, tax compliance.

- Data Privacy Compliance: GDPR, CCPA, and cyber security measures.

- Industry-Specific Compliance: Regulations unique to industries like healthcare, fintech, and manufacturing.

Neglecting compliance can lead to heavy fines, legal disputes, and even business closure. This is why compliance management should be a priority from day one.

2/5

Common Compliance Challenges for Startups

Many startups face compliance challenges due to limited resources and expertise. Some common issues include:

1. Lack of Awareness

Most startup founders are experts in their domain but may not fully understand legal requirements. This can lead to unintentional non-compliance.

2. Changing Regulations

Laws and regulations frequently change, making it difficult for startups to stay updated.

3. Budget Constraints

Hiring a compliance officer or legal expert can be costly, which is why many startups delay compliance management.

4. Document Management Issues

Startups often struggle with maintaining proper records, licenses, and tax documents, which are crucial for compliance audits.

5. Data Security Risks

With increased digitization, startups must comply with data privacy laws like GDPR and CCPA, ensuring customer data is protected.

Ignoring these challenges can result in penalties and reputational damage, making compliance management an essential part of business strategy.

3/5

Key Compliance Areas Startups Should Focus On

1. Business Registration & Licensing

Registering your business is the first step toward legal compliance. Depending on your country, you may need:

- Business registration certificate

- Trade licenses

- GST/VAT registration

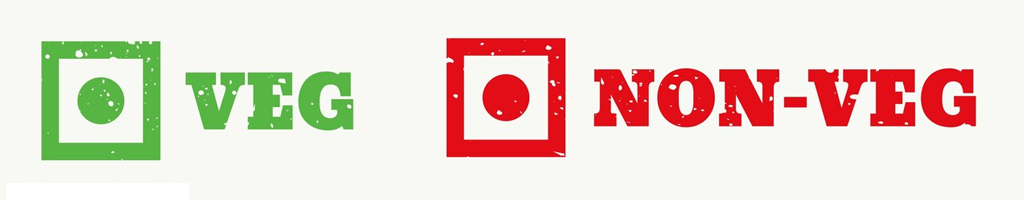

- FSSAI license (for food-related businesses)

2. Tax Compliance

Understanding tax obligations is crucial for avoiding fines. This includes:

- Income tax filings

- GST/VAT returns

- Payroll taxes

- Financial audits

3. HR & Employment Compliance

Hiring employees brings compliance responsibilities such as:

- Employment contracts

- Minimum wage laws

- Workplace safety (OSHA compliance)

- Provident Fund & ESI (for India-based startups)

4. Data Protection & Cybersecurity Compliance

If your startup handles customer data, you must comply with data protection laws like:

- GDPR (General Data Protection Regulation) – Applies to businesses handling EU citizens’ data.

- CCPA (California Consumer Privacy Act) – Applicable if dealing with California residents.

- IT Act (India) – Covers cybersecurity compliance.

5. Intellectual Property (IP) Compliance

To protect your startup’s innovations and branding, consider:

- Trademark registration

- Patent filings

Copyright protection

4/5

How to Implement an Effective Compliance Management System

1. Conduct a Compliance Audit

Assess all legal requirements for your industry and business model. Create a checklist to ensure you are covering all areas.

2. Use Compliance Management Software

Several tools can help startups stay compliant, such as:

- ZenGRC – For governance, risk, and compliance tracking.

- VComply – Manages policy implementation.

- Compliancely – Helps with KYC and AML compliance.

3. Hire a Compliance Expert or Consultant

If your budget allows, hiring a legal consultant can save time and prevent compliance errors.

4. Train Employees on Compliance Policies

Ensure your team understands workplace policies, data security measures, and ethical practices.

5. Monitor & Update Compliance Processes Regularly

Stay informed about regulatory changes and adapt your compliance policies accordingly.

5/5

Benefits of Compliance Management for Startups

Investing in compliance management offers multiple benefits:

- Avoids legal penalties – Reduces risks of fines and lawsuits.

- Builds brand reputation – Customers trust compliant businesses.

- Ensures business continuity – Prevents shutdowns due to non-compliance.

- Attracts investors – Investors prefer legally sound businesses.

- Enhances efficiency – Streamlines operations and minimizes risks.

6/5

Revolutionize Your Compliance with Intelligent Automation

Ez Compliance brings the power of automation to streamline and simplify your compliance processes. From reducing manual tasks to enhancing efficiency, our automation capabilities ensure:

Effortless Workflows

Automate repetitive compliance tasks, freeing up time for strategic decision-making.

Precision and Accuracy

Minimize human errors with intelligent systems designed for flawless execution.

Enhanced Productivity

Empower your team to focus on what matters most, while our automation takes care of the rest.